Search This Supplers Products:Magnesium OxideCaustic Calcined MagnesiteDead Burnt MagnesiteFused MagnesiteMgSO4Magnesium Sulphate

Urea price movement center may move further downward BY:Cherry

time2024/08/15

- Since August, urea futures prices have fluctuated and fallen, and the current main 2501 contract has fallen below 1,900 yuan/ton. Analysts believe that weak demand is the main reason for the decline in urea prices.

Urea price movement center may move further downward

第2部分

Since August, urea futures prices have fluctuated and fallen, and the current main 2501 contract has fallen below 1,900 yuan/ton. Analysts believe that weak demand is the main reason for the decline in urea prices.

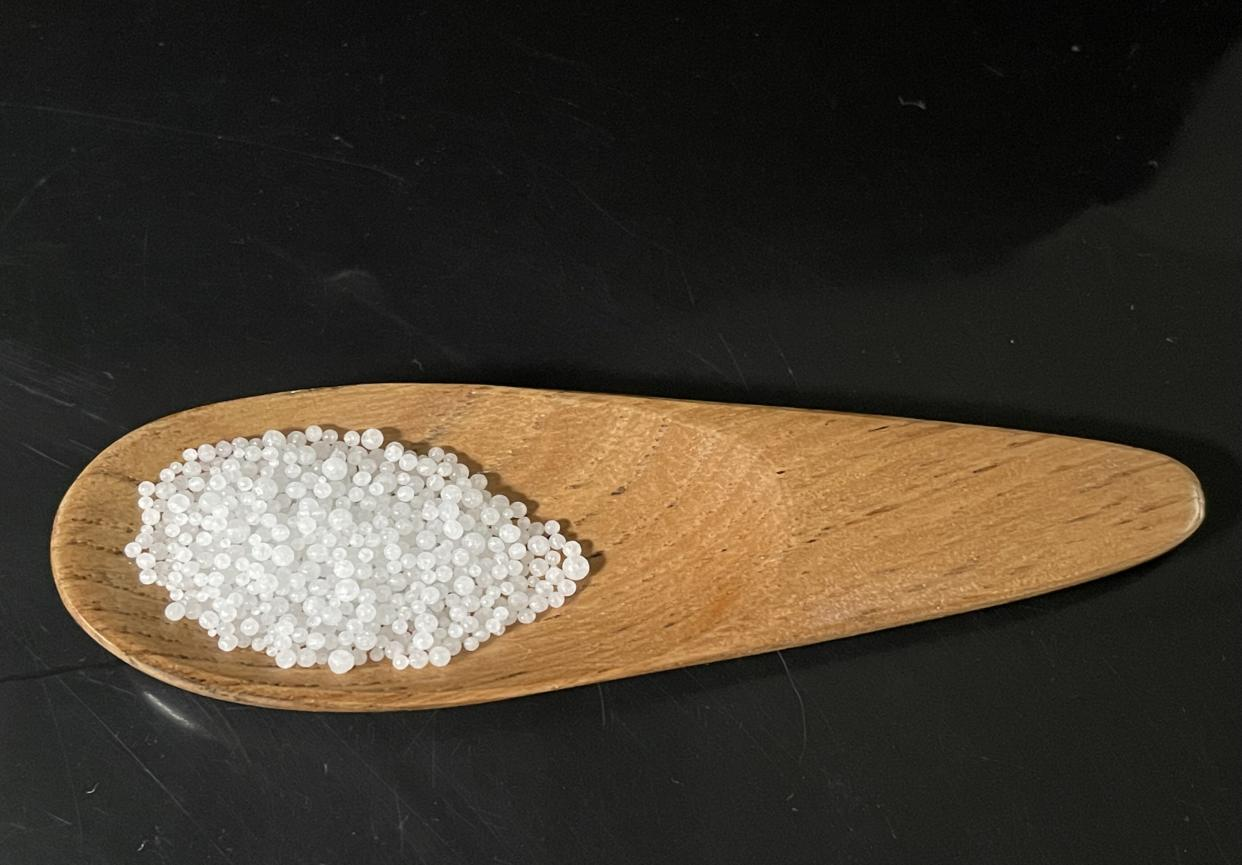

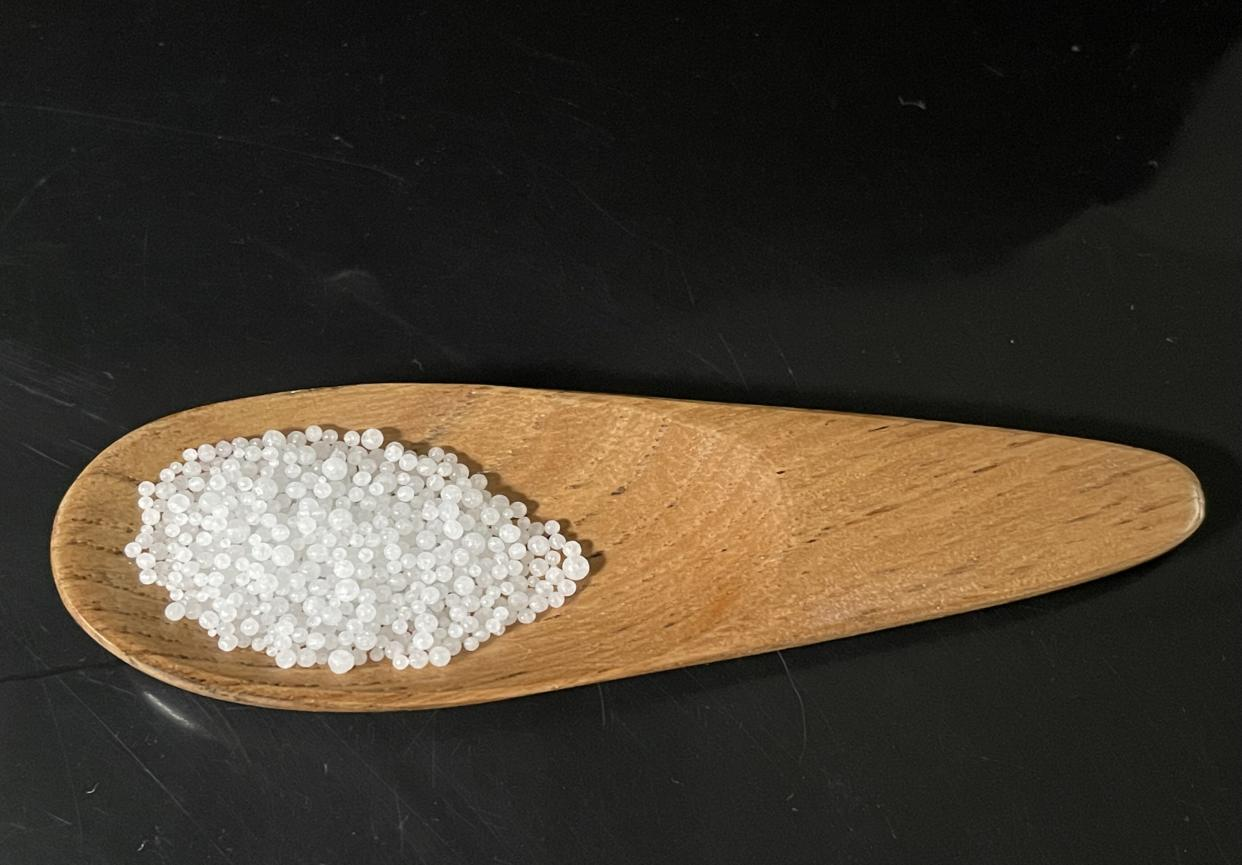

precautions for using urea

Liu Mengmeng, an industrial product analyst at Huishang Futures Research Institute, said that the recent continuous decline in urea futures prices is mainly due to insufficient demand support. Agricultural demand, the largest component of downstream demand, is in the off-season, and August is even in a demand gap period. In terms of industrial demand, compound fertilizer companies are currently producing autumn fertilizers, and the current operating rate has rebounded from a low level to a medium-to-high level, and their demand for urea raw materials has increased. However, since compound fertilizer companies themselves are in a state of accumulated inventory, companies' purchases of raw materials are mainly based on rigid demand, and their enthusiasm for receiving goods is not high. In terms of exports, performance is poor. Although India recently released a new round of urea bidding plans, it is still unlikely that Chinese sources will participate in this round of bidding. In addition, current export controls have not been relaxed, and domestic sales are encouraged.

Liu Shuyuan, an energy and chemical researcher at CITIC Securities Futures, analyzed that in terms of supply, urea production increased significantly from January to July, reaching 37.89 million tons, an increase of 8.5% year-on-year, reaching the highest value in the same period in history. It is expected that in the new round of production cycle, 4.36 million tons of urea capacity will be added in 2024, and the capacity will reach 74 million tons by the end of the year, an increase of more than 6% year-on-year. In terms of demand, agricultural demand in the second half of the year is often weaker than in the first half of the year, and the current downward pressure on agricultural product prices is relatively large, which may lead to weak demand for urea in the medium and long term. In terms of exports, no unexpected policies have been introduced. The Indian bidding information was announced in the early stage, and the domestic export supply connection was limited. As the peak export period of August to November each year, the export volume may decline by 90% year-on-year.

"The overall performance of the demand side is weak, which is one of the drivers of the recent decline in urea futures prices." Zhang Linglu, a senior senior analyst of Everbright Futures Resources, said that the current agricultural demand for urea is in the off-season, the industrial demand is also relatively limited, and the market transaction is relatively light. As of the week of August 15, the apparent consumption of urea was 1.0738 million tons, a decrease of 10.21% from the previous week. In addition, the operating rates of the downstream compound fertilizer and melamine industries were 40.48% and 67.64%, respectively, an increase of 1.73 percentage points and a decrease of 5.31 percentage points from the previous week. The operating rates of different sectors in the downstream of urea increased and decreased.

From the fundamental point of view, Zhang Linglu said that there are certain positives on the urea supply side. Since late July, some large factories in Shandong, Inner Mongolia, Henan, Xinjiang and other places have been overhauled, and the supply of urea has continued to decline. Last week, there were still factories with a capacity of more than one million tons in Shandong, Xinjiang and other production areas, involving a production capacity of 6.2 million tons, and the expectation of increased urea supply was dashed. Data showed that as of the week of August 15, the operating rate of the urea industry was 77.13%, a decrease of 2.19 percentage points from the previous month. The daily output of urea has declined with the decline in the operating rate. Recently, it has dropped to a staged low of 165,000 tons, and then maintained at 170,000 tons. On August 19, the daily output of urea was 169,500 tons, a decrease of 1.28% from 171,700 tons on Friday (August 16).

Despite the reduction in supply, demand is weak and corporate inventories are accumulating. Data show that as of the week of August 15, the inventory of urea companies was 437,200 tons, an increase of 34.81% month-on-month and 65.36% year-on-year. The current inventory level is at the second highest level in the same period in the past five years, but at a relatively low level this year.

Looking forward to the future market, Zhang Linglu said that the sentiment of the external commodity market fluctuated greatly, and the results of the Indian bidding in the international market are about to be implemented. The short-term urea price trend lacks new drivers, but the fluctuation range may increase due to external influences. The spot price of urea has weakened, and some regions have fallen below 2,000 yuan/ton, which may trigger low-end purchasing demand. In addition, after the transfer of urea futures to the next month, the main 2501 contract is currently at a discount to the mainstream price. There is room for basis repair in the futures market. Pay attention to the direction of basis repair.

Liu Mengmeng said that as the overhauled equipment resumes production, the daily output will rise accordingly, and with the addition of new production capacity, the overall supply of urea will return to a high level. In addition, with the addition of new production capacity in India, its import demand has decreased, and its dependence on imports from my country has decreased. In the short term, domestic policies encourage supply guarantee, and the impact of Indian bidding on the market has been reduced. "In the second half of the year, under the environment of increased supply and reduced demand, urea futures prices will fluctuate at a low level." She said.

Liu Shuyuan said that after the supply and demand pressures appeared, the center of gravity of urea spot and futures prices could not be ruled out to move further downward. The support of urea futures 2501 contract below 1600~1700 yuan/ton should be paid attention to. At the same time, pay attention to whether domestic export policies have changed and the specific situation of winter storage.

if you are interested in our products, you can contact us directly through the mailbox, if necessary, you can also use WhatsApp for quick consultation.

————————————————————————————————————————————————————————————————

[Platform release disclaimer]

This platform part of the article picture source or adapted from the Internet, the main purpose is to share information, so that more people get the information they need, the copyright belongs to the original author, such as infringement of your rights and interests or copyrights, please let us know in time, we will be deleted within 24 hours!